Prime Minister Loan Scheme 2026

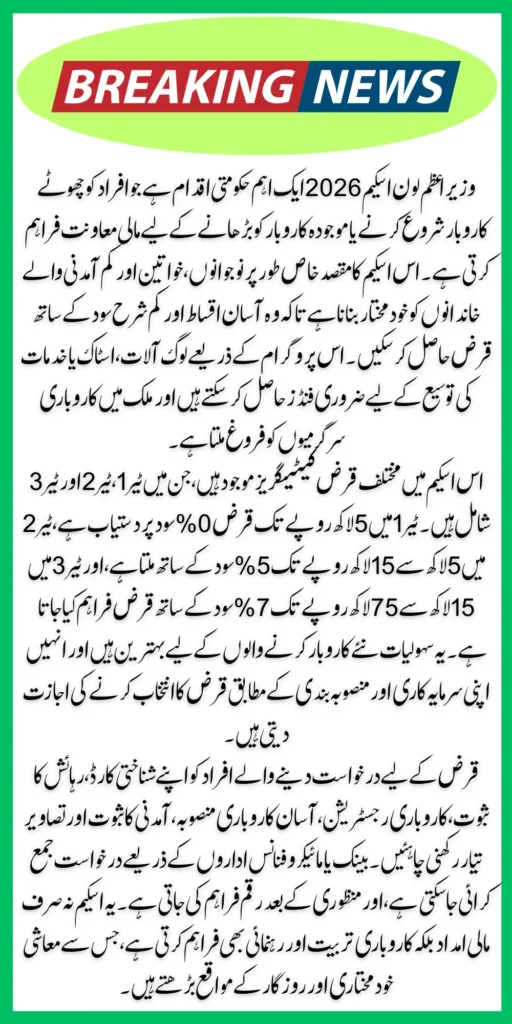

The Prime Minister Loan Scheme 2026 is a government program aimed at helping individuals start or expand small businesses by providing affordable loans. This scheme focuses on empowering youth, women, and low-income families by offering easy access to finance with low interest and flexible repayment options.

If you want to grow your business or become self-employed, this guide explains everything you need to know about the scheme, including eligibility, documents, application process, benefits, and repayment.

You Can Also Read: BISP 8171 Program 2025 Installment Schedule Complete Guide For Eligible Women

What is the Prime Minister Loan Scheme 2026?

This loan program provides financial assistance to entrepreneurs and small business owners across Pakistan. The government collaborates with banks and microfinance institutions to deliver loans ranging from PKR 50,000 to several million rupees. These funds help beneficiaries buy equipment, stock, or expand their services.

The scheme promotes economic growth by encouraging entrepreneurship and reducing unemployment, especially in rural and underprivileged areas.

You Can Also Read: BISP Digital Wallet System Bank Payments Benefits and How To Use To Withdraw 13500

Loan Payment By PM Youth Loan Scheme 2026

The Prime Minister Youth Loan Scheme 2026 offers financial support to empower young entrepreneurs by providing affordable loans across different tiers. These tiers are designed to accommodate varying business needs with flexible repayment plans and competitive interest rates.

| Detail | Tier 1 (T1) | Tier 2 (T2) | Tier 3 (T3) |

|---|---|---|---|

| Loan Amount | Up to PKR 500,000 | Above PKR 500,000 up to 1.5 million | Above PKR 1.5 million up to 7.5 million |

| Interest Rate | 0% per annum | 5% per annum | 7% per annum |

| Repayment Tenure | Up to 3 years | Up to 8 years (max 1-year grace period) | Not specified |

| Eligibility | New businesses with debt-equity ratio 90:10 | New businesses with debt-equity ratio 90:10 | Not specified |

These loan tiers provide tailored financing options to support business growth at various scales. Eligible youth can select the suitable tier based on their capital requirements and repayment capacity.

Who Can Apply? Eligibility Criteria

To apply for the loan, applicants must meet these requirements:

- Be a Pakistani citizen aged 18 to 50 years.

- Own or plan to start a small or medium business.

- Have a valid CNIC.

- No previous loan defaults.

- Women, youth, and disabled persons are given priority.

- Provide proof of business or a valid business plan.

- Belong to low-income or unemployed households.

Meeting these conditions improves the chances of loan approval.

You Can Also Read: Punjab Interest-Free Farm loan Upto 30 Million Know Eligibility Details Step By Step 2025

Documents Needed for Application

Prepare these documents before applying:

- CNIC of applicant.

- Proof of residence (utility bill or domicile).

- Business registration certificate (if available).

- Simple business plan explaining loan use.

- Income proof or bank statements.

- Passport-size photographs.

- Collateral documents if required (depending on loan size).

Having complete documents speeds up the process.

How to Apply for the Loan

If you want to apply for loan, then follow the below steps

- Visit a partner bank as Microfinance or Bank of Punjab, National Bank, Habib Bank And Khyber Bank for KPK residents.

- Collect and fill out the loan application form.

- Submit required documents and business plan.

- Attend interview or on-site verification if requested.

- Await loan approval notification.

- Receive loan amount and start using it for your business.

Many banks also provide online application options for convenience.

You Can Also Read: Benazir Kafaalat July-Sept Payment Updates And New Registration Information 2025

Benefits of the Scheme

This loan scheme offers many advantages that can help small business owners and entrepreneurs grow their ventures. Understanding these benefits will help you make the most of the program.

- Low-interest rates make borrowing affordable for everyone.

- Flexible repayment plans help you manage your finances without stress.

- Minimal collateral is required, especially for smaller loans.

- There is a special focus on empowering women and youth through this initiative.

- Many applicants receive training and business support alongside the loan.

- The scheme promotes financial inclusion by bringing more people into the formal economy.

These benefits combine to create an excellent opportunity for individuals looking to start or expand their businesses with government support.

You Can Also Read: Honhaar Scholarship Program Phase 2 Started Know Key Requirements And Registration Method 2025

Repayment Terms

Knowing the repayment terms clearly is important before applying for the loan. The scheme offers flexible options to accommodate different financial situations.

- Loan terms usually range from 6 months up to 5 years, depending on the amount and type of loan.

- You can repay in monthly or quarterly installments as per your convenience.

- Early repayment is allowed without any penalties, helping save on interest.

- However, late payments may attract penalties, so it’s important to stay on schedule.

- Maintaining a good repayment record increases your chances of getting future loans easily.

By following these terms carefully, borrowers can avoid difficulties and build a positive credit history.

Common Challenges & How to Overcome Them

Applying for a loan can sometimes come with obstacles, but being aware of common challenges helps you prepare better. Here are some issues applicants face and ways to solve them.

- Incomplete or missing documents often delay the process, so gather everything carefully before applying.

- A weak or unclear business plan can reduce your chances; keep it simple and focused.

- If you have previous loan defaults, clear all dues before applying again.

- Lack of knowledge about the scheme can cause confusion; consult bank staff or official websites for guidance.

- Sometimes delays happen, but regular follow-up with the lender can speed things up.

Addressing these challenges proactively increases your chance of success in securing a loan.

You Can Also Read: Benazir Taleemi Wazaif Registration August 2025 For School Going Children Full Process

Conclusion

The Prime Minister Loan Scheme 2026 is a valuable opportunity for those wanting to build or expand their businesses with affordable financing. By fulfilling eligibility criteria and submitting the right documents, you can get easy access to loans that empower you economically.

Whether you live in a city or village, this scheme can support your entrepreneurial dreams and help improve your financial well-being. Prepare your documents, apply through authorized banks, and take a step towards a better future.

پرائم منسٹر لون سکیم 2026 ان لوگوں کے لیے ایک قیمتی موقع ہے جو سستی فنانسنگ کے ساتھ اپنے کاروبار کو بڑھانا یا بڑھانا چاہتے ہیں۔ اہلیت کے معیار کو پورا کرنے اور صحیح دستاویزات جمع کروا کر، آپ قرضوں تک آسان رسائی حاصل کر سکتے ہیں جو آپ کو معاشی طور پر بااختیار بناتے ہیں۔

چاہے آپ شہر یا گاؤں میں رہتے ہوں، یہ اسکیم آپ کے کاروباری خوابوں کو سہارا دے سکتی ہے اور آپ کی مالی بہبود کو بہتر بنانے میں مدد کر سکتی ہے۔ اپنے دستاویزات تیار کریں، مجاز بینکوں کے ذریعے درخواست دیں، اور ایک بہتر مستقبل کی طرف قدم اٹھائیں

You Can Also Read: BISP 8171 New Payment August 2025 Check Now Using CNIC know Full Details Step By Step

FAQs

What is the Prime Minister Loan Scheme 2026?

It is a government program that provides affordable loans to help individuals start or expand small businesses, focusing on youth, women, and low-income families.

Who is eligible for the scheme?

Pakistani citizens aged 18–50 with a valid CNIC, a small or medium business (or a plan to start one), and no previous loan defaults can apply.

What are the loan tiers and interest rates?

Tier 1 offers up to PKR 500,000 at 0% interest, Tier 2 provides PKR 500,000–1.5 million at 5% interest, and Tier 3 offers PKR 1.5–7.5 million at 7% interest.

What documents are needed to apply?

Applicants need their CNIC, proof of residence, business registration (if available), a business plan, income proof, photographs, and collateral documents if required.

How can someone apply for the loan?

Applicants can visit partner banks like NBP, BOP, HBL, or Bank of Khyber, submit the form with documents, attend verification if needed, and receive funds upon approval.